Select the True Statement About Default Risk

UNIT 2 CHALLENGE 2 BOND VALUATION Select the true statement about default risk. C It is the risk that the bondholder will not be able to sell the bond.

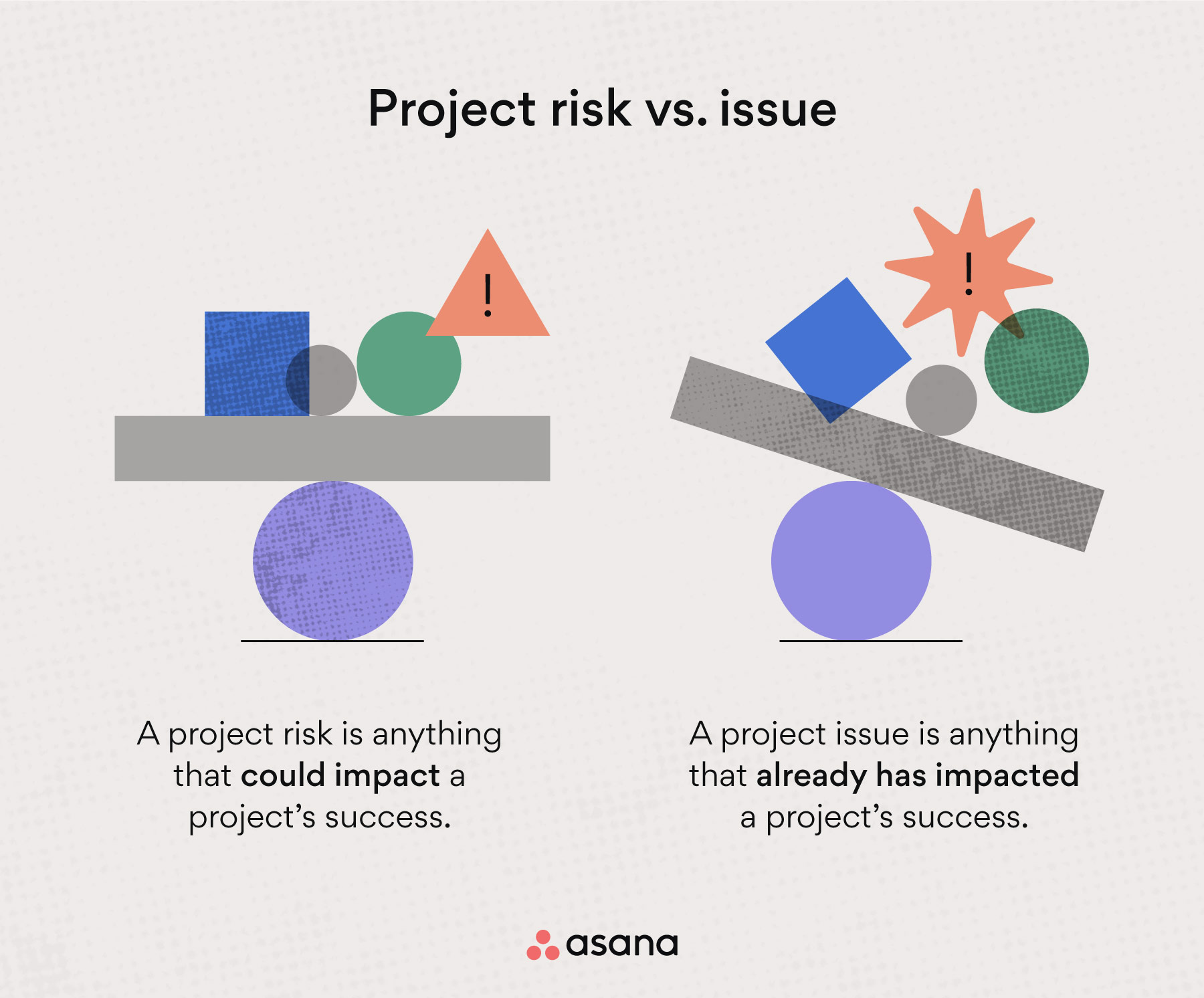

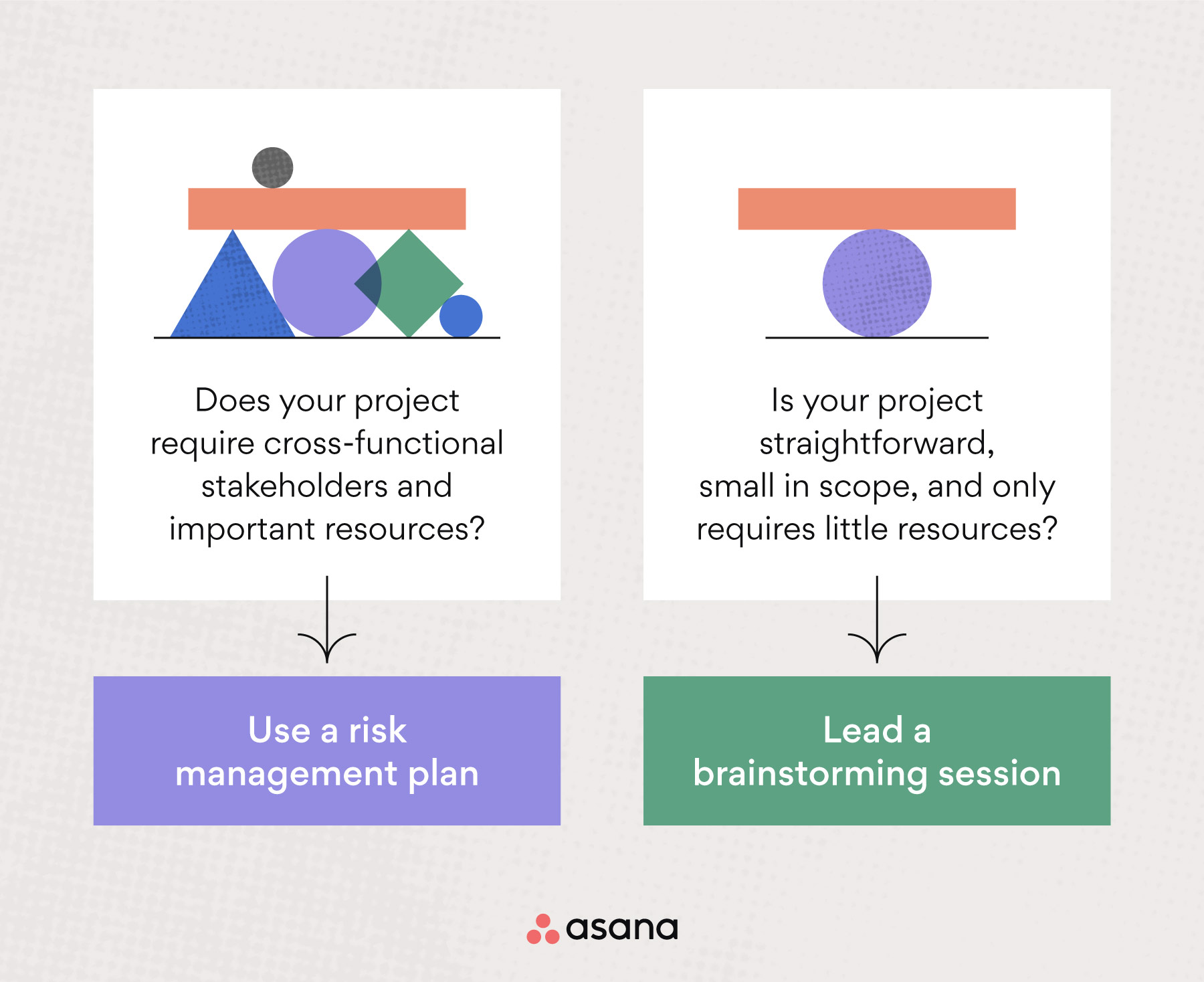

What Is Project Risk Management 6 Steps To Boost Success Asana

It is the risk that the bonds price will fall below its par value.

. Which of the following statements would be true about Erik. The mortgage contract stays fixed for a time before it begins to vary with interest. SAS Enterprise Guide 51 displays HTML output by default.

B Creditors are paid through the sale of assets. C A bondholder may lose some or all of their investment if an issuer enters bankruptcy. Project risk is an uncertain event that even if it occurs has no effect on project objectives.

That conventional mortgages have double the default risk than other types of. Risk management is all about eliminating risk. C It is a greater risk for bondholders than it is for stockholders.

C Default risk relates to a bonds maturity payment but not to its periodic coupon payments. Project risk focuses on identifying assessing and eliminating the risks on the project. B A bondholder may lose some or all of their investment if an issuer enters bankruptcy.

0 It is the risk that the bonds price will fall below its par value. O b Longer-term bonds are less sensitive to interest rate risk than shorter-term bonds. SAS 93 in the windowing environment displays LISTING output by default.

Flexible ARMs protects both lender and borrower from interest rate risk because. B A bondholder may lose some or all of their investment if an issuer enters bankruptcy. Select the true statement about default risk.

0 Bondholders are Course Hero. Select the true statement about default risk. A Memory usage is increased.

BIt is a greater risk for bondholders than it is for stockholders. 0 Default risk relates to a. Identify whether each of the following statements is true or false.

Bondholders are guaranteed to be repaid in full if a company enters bankruptcy. The network is open to third-party risks from using an outside contractor to configure cloud storage settings. 11PNG - Select the true statement about default risk.

Default risk arises from the fact that. When you are finished. Select the true statement about default risk.

A Under Chapter 11 a company is permanently dissolved. Choose all correct answers A When the input does not match any of the cases the default statement is executed. Select the true statement about Chapter 11 bankruptcy.

Select all that apply A. The following table shows the current relationship between bond ratings and default risk premiums DRP. Default risk refers to how adept a company is at withstanding various events that might impair its ability to earn profits.

A Creditors may begin collections actions. Select the true statement about interest rate risk. SAS Enterprise Guide 51 displays Text or LISTING output by default.

Which of the following is a true statement about SAS output. AIt is the risk that the bondholder will not be able to sell the bond. Which two statements are true about the default statement.

D It is the risk. Select the true statement about default risk. AAA - 060 AA - 080 A - 105.

DDefault risk relates to a bonds maturity payment but not to its periodic coupon payments. A free cash flow. A It is the risk that the bondholder will not be able to sell the bond.

Which of the following statements about risk is true. A Default risk relates to a bonds maturity payment but not to its periodic coupon payments. That investors are exposed to both interest rate risk and default risk.

Default risk is the risk that a lender takes on in the chance that a borrower wont be able to make required debt payments. Bondholders are guaranteed to be repaid in full if a company enters bankruptcy. Default risk relates to a bonds periodic coupon payments but not to its maturity payment.

C it is inherently riskier to wait for a capital gain than to receive an immediate interest payment. Select the true statement about default risk. B It is a greater risk for bondholders than it is for stockholders.

A Default risk relates to a bonds maturity payment but not to its periodic coupon payments. And decides to select option 1 because it has no risk. There are no risk-free projects.

Select the best answer for each question. Bondholders have a degree of legal protection against default risk but it is not comprehensive. False SEC requirements provide for disclosures on executive and director compensation particularly concerning 1 options.

The default settings in the network switches represent a weak configuration. C Creditors vote on the businesss reorganization plan. Default risk relates to a bonds periodic coupon payments.

Examine the companys network security posture and select the statements that describe key vulnerabilities in this network. D The business has an opportunity to restructure its debts. C Bonds held until maturity have greater exposure to interest Tate risk d It stems from the fact that coupon rates and.

A borrowers differ in their ability to repay in full the principal and interest required by a bond agreement. Which is a risk of using fully qualified class names when importing. Select the true statement about default risk.

B the bond price drops when interest rates rise. View CapturePNG from FIN 320 at Southern New Hampshire University. A It is the risk that bond prices will fall if market interest rates rise.

B The compiler runs longer.

What Is Project Risk Management 6 Steps To Boost Success Asana

/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)

No comments for "Select the True Statement About Default Risk"

Post a Comment